Imagine earning KSh 10, only to hand over KSh 7 to creditors before you can even think about buying food or paying rent. That’s exactly what Kenya is going through — a nation trapped in a debt spiral that shows no sign of slowing down.

A new report from the Controller of Budget (CoB) has laid bare a worrying truth: Kenya spends nearly 70% of its revenue repaying loans — and most of that money doesn’t even touch the original debt. It just pays interest.

Paying Just to Stay Afloat

In the last financial year, the Kenyan government spent KSh 632.3 billion on interest payments, and only KSh 360.1 billion went toward reducing the actual debt.

To put it simply, Kenya isn’t paying off its loans — it’s renting its freedom from creditors.

Experts warn that this is the classic sign of a debt trap, where a country borrows more money not to grow, but to survive.

“We are now borrowing to pay old loans, not to build roads or create jobs,”

said an economist based in Nairobi.

The Ripple Effect: When Debt Touches Every Household

For the average Kenyan, these numbers translate into higher taxes, rising fuel prices, and delayed public services.

Counties are struggling to receive funds on time, hospitals are facing shortages, and major development projects have stalled.

It’s the ordinary mwananchi who feels the pinch — from matatu fares to unga prices — while the government fights to stay financially afloat.

“We keep hearing about billions borrowed, but our lives don’t improve,”

said a teacher from Kisii.

“Where does all that money go?”

Why Kenya’s Debt Keeps Rising

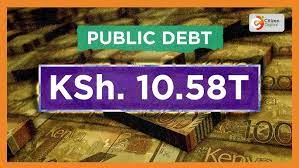

Kenya’s public debt now stands at KSh 11.73 trillion, and it’s rising fast.

Most of this debt comes from domestic borrowing, which carries high interest rates and short repayment periods.

Economists say that’s part of the problem: Kenya is borrowing from local banks at expensive rates to repay older debts — a dangerous cycle that’s eating up the nation’s future.

The CoB report also warns that if the current trend continues, Kenya could face a debt distress situation, forcing more borrowing just to pay interest.

A Race Against Time

The Controller of Budget has called on the government to take urgent action:

-

Shift to cheaper, long-term concessional loans.

-

Reduce domestic borrowing.

-

Seal revenue leaks and corruption gaps.

-

Prioritize projects that create revenue instead of draining it.

But even with these recommendations, reversing the damage won’t be easy. Kenya’s financial commitments are so high that even minor shocks — like a weak shilling or global interest hikes — could push the country to the edge.

The Bigger Picture: A Nation at a Crossroads

Kenya’s debt story is more than numbers — it’s a reflection of leadership choices over decades. From mega infrastructure loans to pandemic borrowing, every administration has added its share to the pile.

Now, the country stands at a turning point.

Either it chooses fiscal discipline and reforms — or it continues sinking deeper into dependency.

For millions of Kenyans struggling to make ends meet, the question remains: If KSh 7 of every KSh 10 goes to debt, what’s left for us?

Summary:

Kenya’s debt crisis is not just a government problem — it’s a people’s problem. Every delayed salary, every stalled hospital, and every tax increase is a reminder of how deep the hole has become.

Unless bold action is taken, Kenya may find itself working only to pay the past, not to build the future.